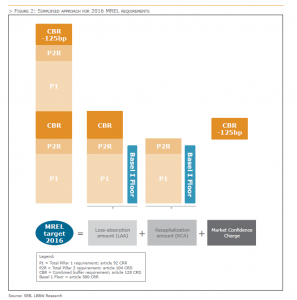

Minimum Requirement for Own Funds and Eligible Liabilities (MREL) SRB Policy for 2017 and Next Steps

General approach of the Czech National Bank to setting a minimum requirement for own funds and eligible liabilities (MREL) - Czech National Bank

The Bank of England's approach to setting a minimum requirement for own funds and eligible liabilities (MREL) - Policy Stateme

The Bank of England's approach to setting a minimum requirement for own funds and eligible liabilities (MREL)

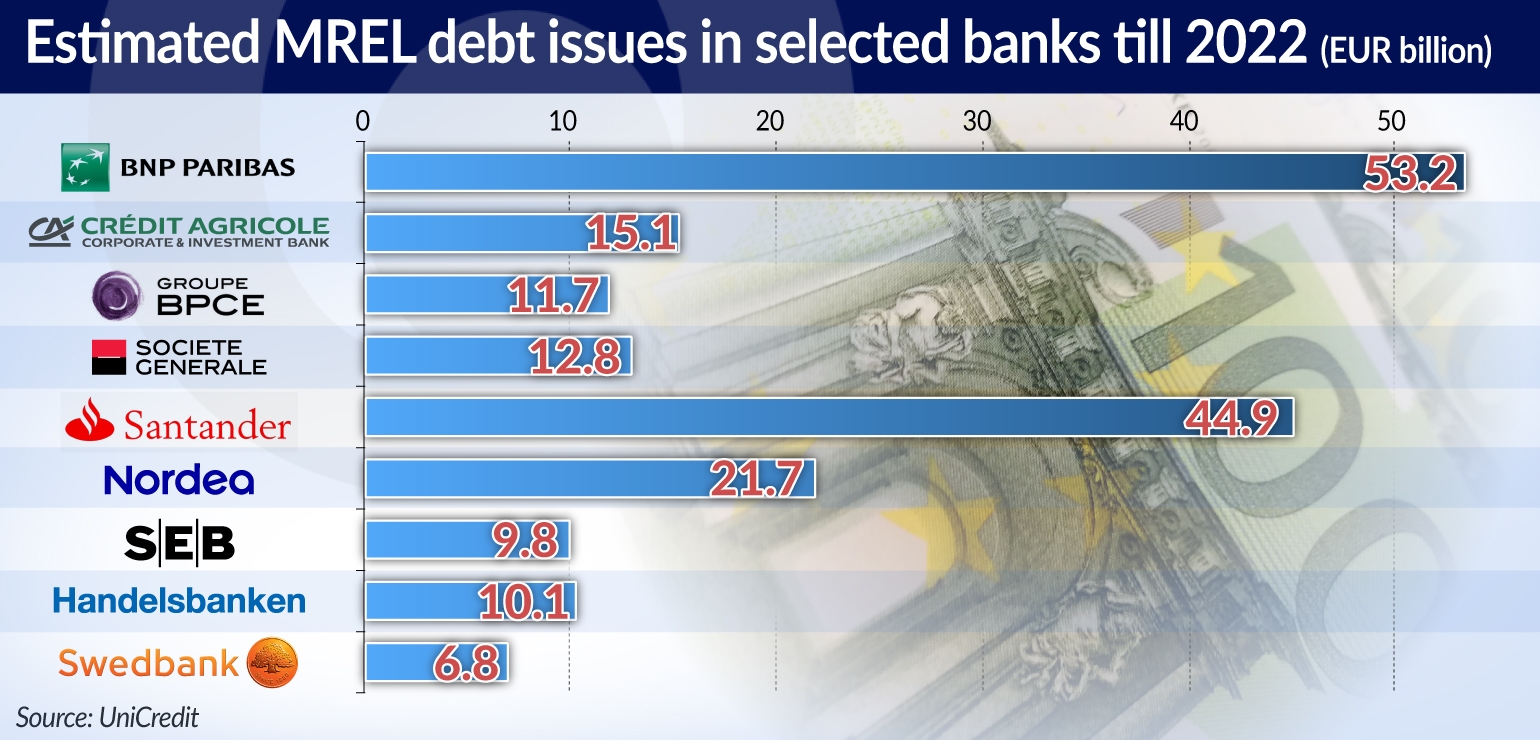

EU Banking Authority - EBA 🇪🇺 on Twitter: "🔴 #EBA shows banks' progress in planning for failure but encourages them to issue eligible debt instruments ➡️ authorities made progress in agreeing resolution

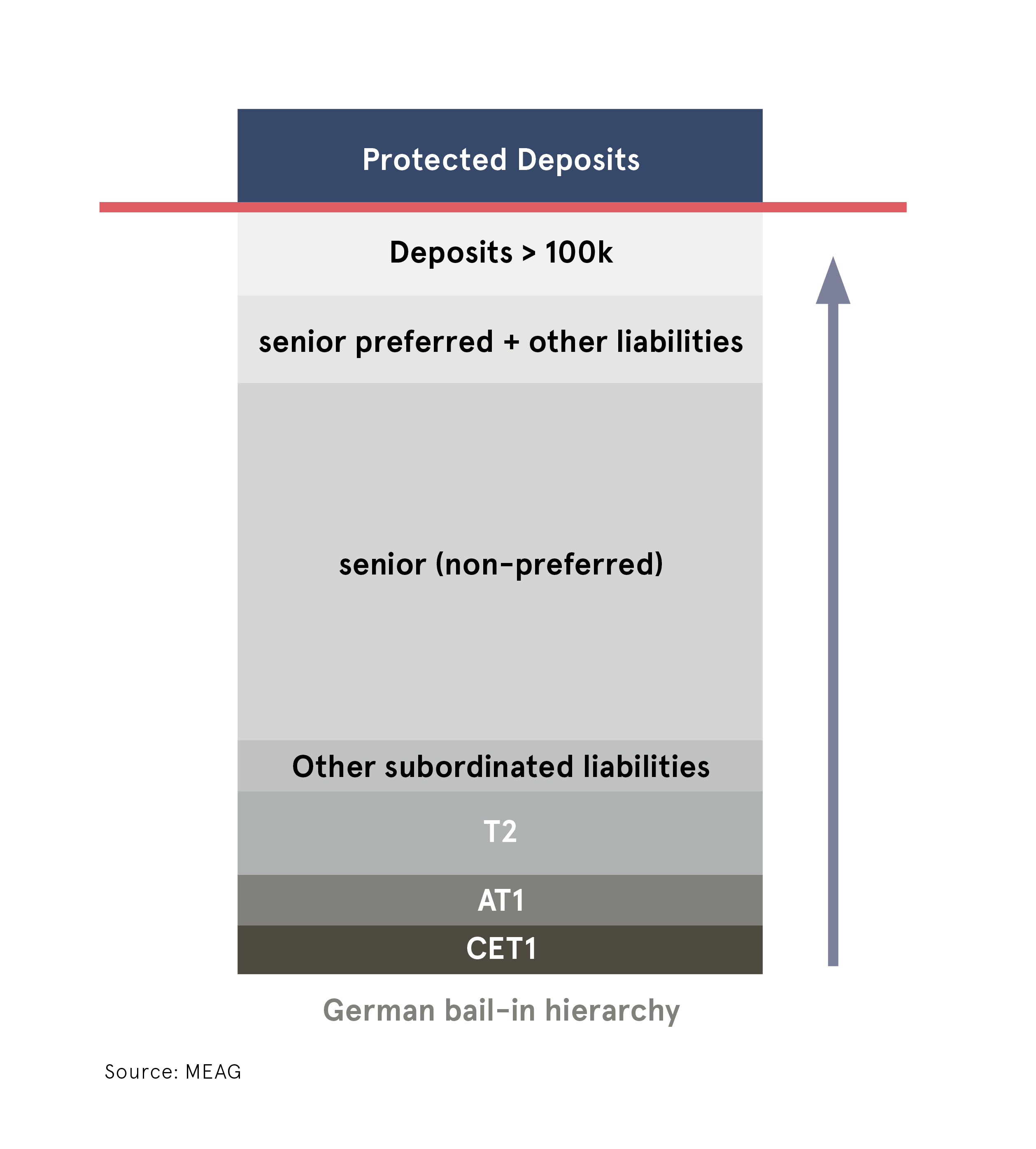

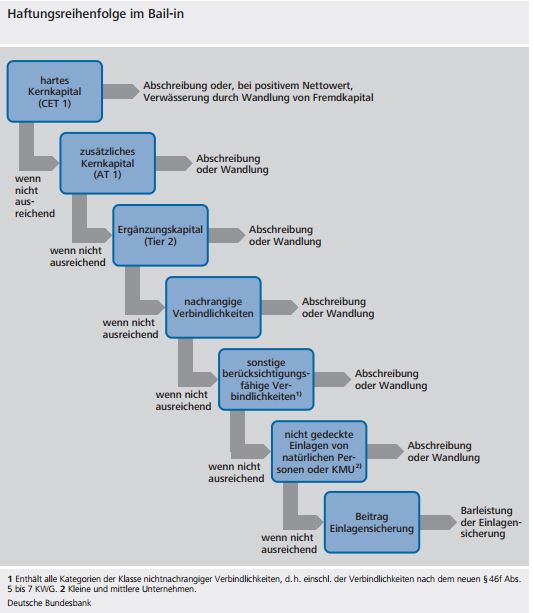

MREL will be a challenge for banks and regulators | Obserwator Finansowy: Ekonomia | Gospodarka | Polska | Świat

Bail-inable securities and financial contracting: can contracts discipline bankers? | European Journal of Risk Regulation | Cambridge Core